By Andrew Tar

The ICO market boomed in 2017. The number of crypto startups is hard to pin down, but most sources agree that over five hundred were launched in 2017. In fact, every day last year at least one project was launched, and those ICOs raised more than $5 billion. This year the trend has continued. By mid-year, the number of ICOs launched was already over 550, and the total raised funds were over $12 billion.

The industry is flourishing but is it as good as it seems to be? The research shows that ICOs have significant economic problems.

Problems in the ICO economy

One of the major problems is bad economic policies. Crypto entrepreneurs don’t properly think about the future of their tokens. Reviewing a security tokens list will reveal some projects trying to address these issues, but the problems still linger. Tokens can be considered as a main economic basis of the crypto industry and have some similarities with money in the greater financial world.

Liquidity is a significant parameter for any financial asset and shows how fast the asset can be converted to cash. In other words, liquidity represents how fast you can buy or sell something.

Highly liquid shares (usually the stocks of the leading companies) can be bought or sold at any time in almost any quantity. A lot of people deal in them and the trading volume is huge. You won’t have difficulty buying or selling these equities. Stocks with low liquidity are less interesting for investors. To buy or sell them, you have to make an effort to find a partner and make a deal.

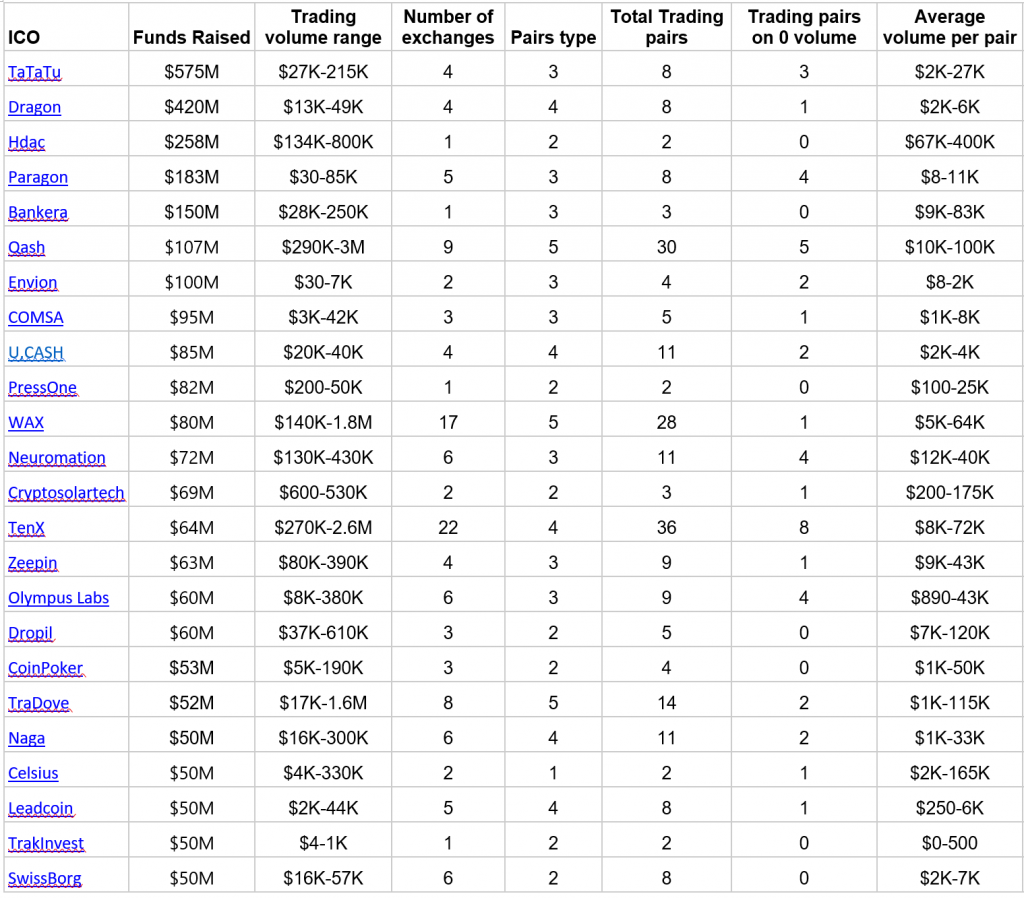

Examining the cryptocurrency market, you may find that most of the tokens have extremely low liquidity. For the purposes of this article, we’ll look at the liquidity of tokens that are traded on crypto exchanges and raised at least $50 million in their ICO.

The first thing you will notice is low trading volumes. Some tokens are generally held in crypto wallets and are hardly moving on the market. For example, for the last month the daily trading volume of TRAK token was barely over $2,000. There were a few days when the volume was 0. According to CoinSchedule, this ICO collected $50 million.

The recent project Dragon raised over $420 million and became the sixth largest ICO in history. If you look at the graphs, you will discover that tokens were traded no more than $65,000 per day.

Another “amazing” project is Paragon. In 2017, the founders attracted more than $183 million in investments. Now the trading volume of its token doesn’t exceed $100,000 on exchanges.

As a result, token circulation is rather low. The vast majority of tokens are just held in wallets and are actually out of the market. Many tokens have less than 1% of the total amount in circulation.

At the same time, large transactions are disastrous for such markets. If someone wants to buy or sell a significant amount of tokens, the deal can shake the market. Under those circumstances, the person can actually become a monopolist, and that person is able to change the price. The owner of a large amount of tokens can manage the market and influence the project. Obviously, this is unacceptable for financial markets.

These projects are not the only ones but just major examples. More information about these projects and others is given below.

* The circulating supply is unknown, the total supply is given instead.

Do exchange listings help?

A lot of ICOs are listed on different exchanges and have different trading pairs. As a rule, listing requires a large amount of money. News about new listings makes prices go up and stimulates people to trade. But are listings actually that effective?

PAY token (for the project TenX) is listed on 22 exchanges and has 36 trading pairs. However, the exchange Bithumb accounts for almost 32% of deals with the token on its own. Just one pair -- PAY/KRW (the Korean won) -- listed on Bithumb and Cashierest accounts for 93.67% of trading. The volume of others is less than 10%. Eight pairs have 0 trading volume.

This does not only apply to ICOs with a large number of exchanges listed. U.CASH is listed on four exchanges and has eleven trading pairs. There are just three effective pairs located on just one exchange, Extrates, accounting for 94.36% of all transactions.

The concept “the more the better” is not accurate here. Moreover, some exchanges have a special paragraph in the terms. It says that the administration can remove the token. Thus, it is much more efficient for ICO founders to choose a couple of exchanges and a small number of trading pairs.

Such liquidity problems have a severe negative effect on the crypto community. People begin to mistrust ICOs. At a certain point someone may want to get their money back but it’s hard to sell the assets. The time has passed, and the profit is lost. It diminishes the motivation to invest in the crypto industry. It turns into a vicious cycle: “prices don’t change because people don’t trade tokens since prices don’t change...” Because of this, retail investors are upset about crypto projects.

There is a possible way to improve the current situation. The founders should make some real product, or minimum viable product (MVP) and think about the roadmap. If the startup doesn't demonstrate progress for a long time, people lose their faith in the project. The research group Satis Group LLC determined that 81% of ICO projects are scams and do nothing to improve the product. When the token is traded on crypto exchanges, they try to get rid of the coins and the price falls. According to Coinist, about 79% of all tokens have decreased in value since the launch of the project.

If the product is live, and the token is listed on some exchanges, the founders should enable users to buy the token on their platform and connect it to exchanges. Providing an easy way for users to trade the token and use it on the platform will increase the liquidity of the token.

ICOs started to launch in 2014 and now they are continuing their victorious march. The number of projects grows from year to year. The average size of raised funds is increasing. This year will be remembered for EOS and Telegram Open Network with billion capitalizations. Nonetheless, ICOs have real problems. A lot of projects don’t upgrade the product. Most tokens are not traded and lose their price. Listings on crypto exchanges and a large number of trading pairs don’t change the situation as entrepreneurs suppose they should. It will take some time to form the industry and establish the rules on how to start a successful blockchain-based projects. Apparently, it’s not time yet.

About the author: Andrew Tar is a crypto writer and researcher. As a journalist, he made researches for leading news agencies in fintech. He is interested in technical aspects of blockchain and working with statistics.