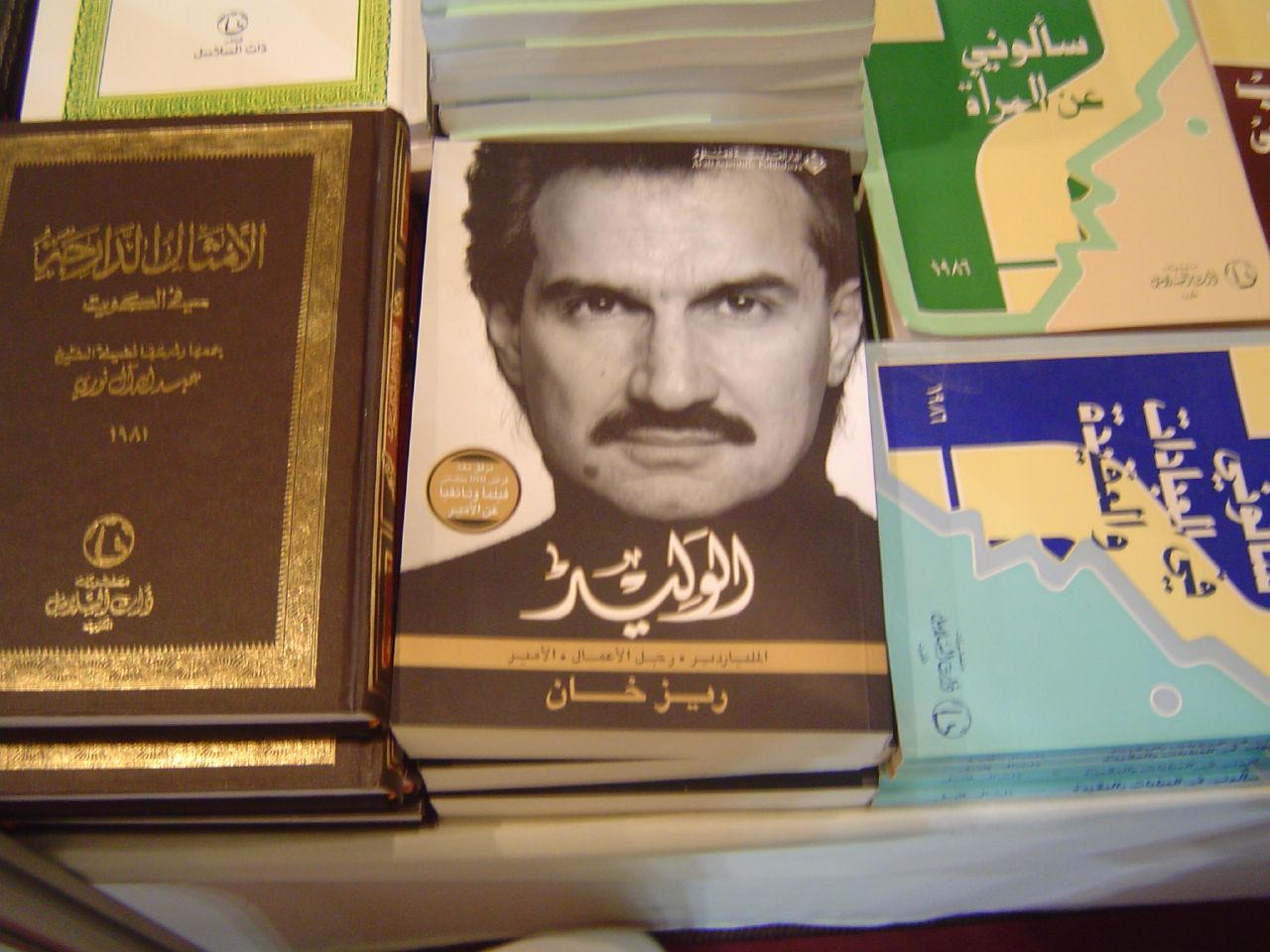

The prominent billionaire investor from Saudi Arabia, Prince Alwaleed bin Talal, recently cautioned investors that the bitcoin price will implode one day. This warning follows several others that have recently emerged from the financial world, including JP Morgan CEO, Jamie Dimon, as well as Blackrock (BLK) CEO, Larry Fink. Dimon recently denounced Bitcoin as fraudulent, while Fink stated that Bitcoin is an index of money laundering.

In a CNBC interview, Alwaleed stated that Bitcoin makes no sense and that the lack of regulation and control is bound to cause a price implosion. Currently, Alwaleed holds position no. 50 on the Bloomberg Billionaires Index. Alwaleed confirmed that he believed an implosion to be inevitable, stating that Bitcoin is Enron in the making. Enron is the infamous high-profile energy company that imploded during an accounting scandal during the early 2000s.

Alwaleed’s interview followed in the wake of bitcoin’s market value reaching an unprecedented $100 billion just last week. This record achievement is much higher than either the Goldman Sachs (GS) or Morgan Stanley (MS) market values which reached $10.4 billion in 2016.

Since its record high of Friday of last week, the overall market value of bitcoin dropped slightly to $97 billion. This report is according to CoinMarketCap, an institution which tracks and lists the prices of more than 1,000 different types of cryptocurrencies. Most of the digital currencies listed are incredibly low in value and don't have a market demand.

Just last week, the director of research at Pension Partners, Charlie Bilello, wrote in his blog that it seems unlikely that Bitcoin will prove to be nothing more than the latest tech craze bubble, even in the event of the cryptocurrency crashing. Bilello wrote that the price has experienced such severe falls and rises over the past seven years and that there's no possible way to establish whether Bitcoin is a bubble, even in hindsight. Bilello continued to write that people declare something a bubble once the value hits zero. However, Bilello argued, that this is not an effective way of judging bubbles. As we have seen with Nasdaq and housing bubbles, both have crashed and recovered.

Many financial experts have speculated that bitcoin’s latest soaring price could hugely affect retailer adoption within the US. If the price does crash, it seems unlikely that retailers will implement bitcoin payment options, despite the growing popularity of the currency amongst the public.

Despite bitcoin’s ample high-profile critics, there are equally high-profile advocates. Abigail Johnson, CEO of Fidelity Investments has confirmed her belief in the cryptocurrency by stating that she has not given up on digital currencies and the possibilities they have to offer.

Regulatory institutions across the world have vastly different approaches when it comes to regulating digital currencies. While China and South Korea have completely banned all initial coin offerings (ICOs), Japan has declared Bitcoin as legal tender, which in turn, greatly supported the continued rising price of the cryptocurrency. In addition, the Japanese Financial Services Agency has officially approved 11 different firms which will serve as the country's official cryptocurrency exchange platform. However, in the US, regulatory bodies have issued a warning that ICOs might become subject to increased security laws and regulatory requirements.

According to the researchers, China did not provide any reason behind their decision to outright ban ICOs, however, the researchers speculated that it is likely out of concern for the safety of Chinese investors, as well as the growing amount of fraudulent ICOs.

In a CNBC interview, Alwaleed stated that Bitcoin makes no sense and that the lack of regulation and control is bound to cause a price implosion. Currently, Alwaleed holds position no. 50 on the Bloomberg Billionaires Index. Alwaleed confirmed that he believed an implosion to be inevitable, stating that Bitcoin is Enron in the making. Enron is the infamous high-profile energy company that imploded during an accounting scandal during the early 2000s.

Alwaleed’s interview followed in the wake of bitcoin’s market value reaching an unprecedented $100 billion just last week. This record achievement is much higher than either the Goldman Sachs (GS) or Morgan Stanley (MS) market values which reached $10.4 billion in 2016.

Since its record high of Friday of last week, the overall market value of bitcoin dropped slightly to $97 billion. This report is according to CoinMarketCap, an institution which tracks and lists the prices of more than 1,000 different types of cryptocurrencies. Most of the digital currencies listed are incredibly low in value and don't have a market demand.

Just last week, the director of research at Pension Partners, Charlie Bilello, wrote in his blog that it seems unlikely that Bitcoin will prove to be nothing more than the latest tech craze bubble, even in the event of the cryptocurrency crashing. Bilello wrote that the price has experienced such severe falls and rises over the past seven years and that there's no possible way to establish whether Bitcoin is a bubble, even in hindsight. Bilello continued to write that people declare something a bubble once the value hits zero. However, Bilello argued, that this is not an effective way of judging bubbles. As we have seen with Nasdaq and housing bubbles, both have crashed and recovered.

Many financial experts have speculated that bitcoin’s latest soaring price could hugely affect retailer adoption within the US. If the price does crash, it seems unlikely that retailers will implement bitcoin payment options, despite the growing popularity of the currency amongst the public.

Despite bitcoin’s ample high-profile critics, there are equally high-profile advocates. Abigail Johnson, CEO of Fidelity Investments has confirmed her belief in the cryptocurrency by stating that she has not given up on digital currencies and the possibilities they have to offer.

Regulatory institutions across the world have vastly different approaches when it comes to regulating digital currencies. While China and South Korea have completely banned all initial coin offerings (ICOs), Japan has declared Bitcoin as legal tender, which in turn, greatly supported the continued rising price of the cryptocurrency. In addition, the Japanese Financial Services Agency has officially approved 11 different firms which will serve as the country's official cryptocurrency exchange platform. However, in the US, regulatory bodies have issued a warning that ICOs might become subject to increased security laws and regulatory requirements.

According to the researchers, China did not provide any reason behind their decision to outright ban ICOs, however, the researchers speculated that it is likely out of concern for the safety of Chinese investors, as well as the growing amount of fraudulent ICOs.