Disclaimer: NOT FINANCIAL ADVICE

Market & Investment Insights

1. Continued active investment amid crypto market lull

Market Insights:

April of 2022 saw a reduction in the total cryptocurrency market cap of 15.32%, from 2.09 trillion to 1.78 trillion.

[Source: CoinMarketCap]

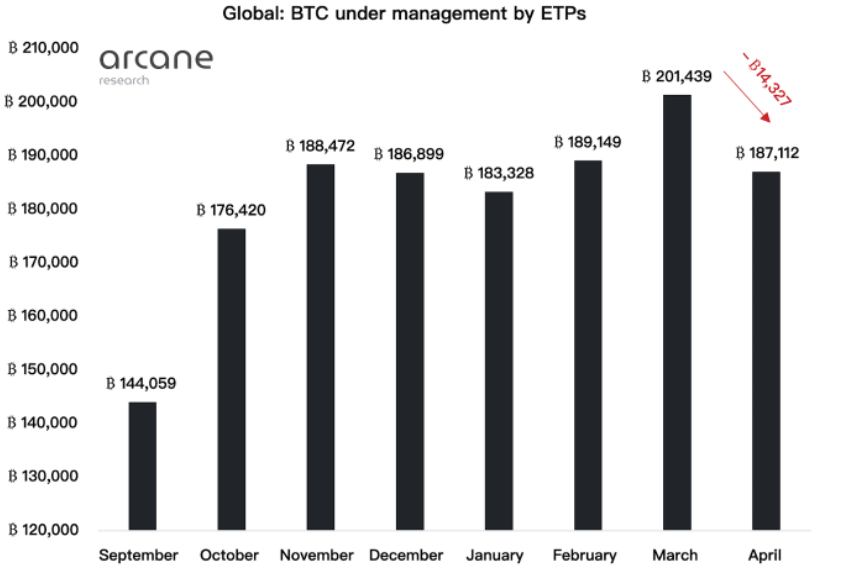

April also saw the largest monthly net outflows in BTC ETP history, with outflows amounting to 14,327 BTC. Trends indicate sharp de-risking and the preference for gold as a vehicle for hedging against uncertainty.

[Source: Arcane Research]

In April, Bitcoin’s 30-day correlation to tech stocks climbed to highs not seen since July of 2020. Difficult months for tech are being pointed to as the key force behind the crypto sector’s poor performance since November. However, such high levels of correlation with the tech sector are not expected to continue.

Bitcoin has also been closely correlated to the Nasdaq 100 index since the start of the pandemic. The 40-day correlation between the two reached a record of 0.6945 on April 8, further eroding the argument that Bitcoin works well as a diversifier.

Blockdream Ventures Outlook:

Despite the fact that the crypto market is going through a difficult period, we invested in four outstanding new projects in April.

Regardless of market conditions, we will continue to back the companies we have invested in and seek out great opportunities for new investments in the sector.

2.NFT market briefly resurgent as we proceed with long-term strategy

Market Insights:

In April, NFTs saw a surge in trading volume, reaching over $6 billion for only the third time in history.

Coinbase, one of the largest crypto exchanges globally, launched its NFT marketplace on April 20 and saw sales volume of $668,668 and 1,287 test users according to Dune Analytics data.

Blockdream Ventures Outlook:

As for possible fluctuation, the global NFT market may experience a drawdown in May.

However, we maintain a positive outlooking regarding the development of the NFT market. Cointelegraph expects that the existing $3 billion market will grow to $13.6 billion by the end of 2027.

We hold that the development of the necessary NFT infrastructure is still at an early stage, and expect that high-performance infrastructure will continue to contribute to the growth of the NFT ecosystem.

It is expected that these new developments will be in areas such as a new public chain for NFTs, a side chain and L2 solutions for high-performance NFTs, customized underlying infrastructure for specific scenarios, and multi-chain NFT protocols for interoperability and composability.

3. Taking a hard look at “X to Earn”

Market Insights:

The popularity of “X to Earn” began with “Stake-to-Earn” models in the DeFi space. Now, the space has expanded to include everything from Axie Infinity’s “Play-to-Earn” model to StepN’s “Move-to-Earn”.

Blockdream Ventures Outlook:

We have received a lot of proposals regarding “X to Earn”. However, we hold that the recent popularity of the “X to Earn” model does not mean that everything can be “X to Earn”.

We believe that the core of any “X to Earn” project needs to be clearly defined. To do this projects should:

- Choose a clear direction, select a design form with flexible configuration and open themselves to timely feedback

- Split design elements, retain quantifiable behavior patterns, and consider market efficiency and low-friction market costs

- Design around labor value to make the network more durable and more valuable, and create more externalities

We expect more integration and innovation from entrepreneurs and startups in this field.

About OKX Blockdream Ventures

OKX Blockdream Ventures is the investment arm of the world-leading global cryptocurrency trading platform OKX.

We help entrepreneurs build great companies, supporting cutting-edge blockchain innovation and promoting the development of the global blockchain industry. The initial capital of OKX Blockdream Ventures is USD 100 million.

Media Contacts

For further information, please contact:

Richard Kay, Global Communications Lead, OKX

Jack Sutherland, Communications Manager, OKX

Or reach out to [email protected]

Disclaimer: NOT FINANCIAL ADVICE