Preface

My name is Grant Gulovsen, and I am an attorney based in the United States who has been working with clients in the blockchain and cryptocurrency industry since mid-2017. When I was offered the opportunity to write a guest post for Cointelligence I accepted immediately, as I share its core values of promoting transparency and education in our industry, evidenced in part by my co-founding the semi-satirical—and much-maligned by “experts” from other review sites —ICO review site Tokenicide! in March of 2018.

I wanted to write about a topic that has been gaining more and more attention as the echoes of the $13 billion ICO industry reverberate less frequently and fade into the past. That topic is “digital securities,” which, until recently, were more commonly known as “security tokens” (and which, according to SEC Chairman Jay Clayton at least, ware more commonly known as “utility tokens,” see below). In particular I would like to map the interplay between ICOs and STOs – sorry DSOs —to try and make sense of what has happened to them over the past year, beginning with what I consider to be the most critical moment in their history:

2/6/2018 - THE DAY THE MUSICO DIED

On February 6, 2018, Chairman Jay Clayton of the U.S. Securities & Exchange Commission uttered the following words at a hearing before the United States Senate: “I believe every ICO I've seen is a security.” Prior to that moment, news stories about security tokens and STOs digital securities and DSOs (sorry, habit) had been gaining momentum, but that statement by Chairman Clayton opened the floodgates. In addition to the media reports, many believed that this would mark the beginning of a tidal wave of regulatory actions that would shut down ICOs once and for all. To many, especially those who foresaw the collapse of the ICO market and had been preparing for a transition to digital securities, Jay Clayton was signaling his intent to open a regulatory can of whoop-ass on ICOs.

[caption id="attachment_99283" align="aligncenter" width="356"] Alright, which one of you ICOs ordered the “Jay Clayton Surprise?”[/caption]

Alright, which one of you ICOs ordered the “Jay Clayton Surprise?”[/caption]

Or … Not?

Although the number of news stories proclaiming the death of the ICO nearly doubled following Chairman Clayton’s remarks, ICOs continued to raise over $500 million USD each month through June of 2018. On the enforcement side, the SEC only shut down seven (7) ICOs between February and December of 2018. There was of course additional activity at the state and international level but suffice it to say that the aforementioned can of whoop-ass turned out to be more like a drink-box full of frowny faces.

OR … MAYBE?

By the fall of 2018, however, it was becoming clear that all was not right in the land of ICOs, as the amounts they were raising began to drop off precipitously, and those projects that did manage to fundraise successfully and get listed on an exchange began seeing their tokens crash the moment they were listed (not to mention the increasing number of projects that were including inter-project token swaps in their fundraising totals—don’t even get me started). Fast forward to December of 2018 and the number of ICOs being admitted into ICUs was reaching epidemic proportions. With the exception of the occasional anecdotal and unverifiable claim, ICOs are, for all practical purposes, deader than a parrot in a Monty Python sketch. So, who, or what, is responsible?

What killed the ICO?

Many theories have emerged as to the ultimate cause of death for ICOs. Personally, I don’t think the regulators had anything to do with it. I believe it was an inside job, or to be more specific, death by self-inflicted wounds. It’s because the markets finally realized, after months of ridiculous stories about “utility value of tokens” and “network effects” and “community building” that the entire ICO fundraising model was busted and it was impossible to get any positive ROI unless you actively participated in a pump & dump or were privy to insider information. In effect, Adam Smith’s invisible hand finally realized what was going on and gave ICOs the finger.

Enter the STO DSO

Given the collapse of the ICO market, attention has naturally turned to what had been promoted as the “compliant” alternative to ICOs, namely digital security offerings, or DSOs. I, for one, predict that in a few years’ time, all publicly traded securities will utilize some form of distributed ledger technology and involve tokenization. So, there is no doubt in my mind that digital securities are a “thing” which makes it worthwhile for people in our industry to learn about them.

However, “learning about digital securities” and “replacing the term ‘ICO’ with ‘STO’ or ‘DSO’ in your personal or company LinkedIn profile” are not the same thing. Trying to advise a DSO without having the slightest clue about what a compliant digital security offering actually involves has enormous potential negative consequences for the advisor, the company he or she is advising, as well as the digital security industry. Heck, even the entire cryptocurrency industry could be affected—see, e.g., the crypto market of 2018 as Exhibit Number 1. Please, let’s not go through that again!

A DSO should not be used like an ICO

Finally, even though I believe that digital securities are important and will eventually become ubiquitous (and as far as I’m concerned this is a very good thing for the entire industry), DSOs should not be thought of as an effective replacement for ICOs. That’s because, at the end of the day, a DSO, like an ICO, is nothing more than a fundraising method. Consider the following:

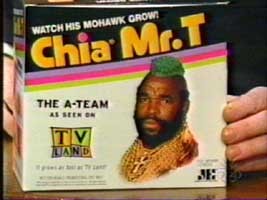

Let’s say you’re trying to raise money to fund the production of your lifelong dream project – an 11-hour documentary on the history of the Chia Pet entitled, “An 11-Hour Documentary on the History of the Chia Pet.”

[caption id="attachment_99285" align="aligncenter" width="267"] Honestly, 11 hours probably isn't long enough[/caption]

Honestly, 11 hours probably isn't long enough[/caption]

You may believe that this project is a good investment, because after all, it has been your lifelong dream, but to every other person on the face of the earth, it is probably the worst possible investment opportunity they have ever seen.

Back in 2017, you could have tried to raise funds via an ICO and, God forbid, maybe even been successful. And that’s because ICO investors really didn’t care about the project – they just cared about the token.

Now, in 2019, if you try to raise funds via a DSO, pretty much nobody is going to invest in your project. Nobody. That’s because (a) unlike ICO-based tokens, digital securities carry restrictions which means they wouldn’t be tradable for up to a year or more in many cases, and (b) your project is simply terrible.

And even if, through some bizarre twist of events, the likes of which would almost certainly require some degree of divine intervention to pull off, you were able to find someone to help fund your Chia Pet Movie, you would probably be better off raising funds the traditional way, because digital securities have a higher cost barrier to entry than simply issuing shares of stock or something similar.

Although STOs might be “cleaner and more compliant” ways to fundraise when compared to ICOs, if the fundamentals aren’t sound and there is a lack of any articulable value proposition, an STO will not help a project be successful.

Conclusion

There are very good use cases for digital securities, and if done properly, a compliant DSO is a much more transparent and “investor-friendly” means of fundraising than virtually any ICO I have ever seen. But using a DSO to fund an early-stage startup, especially one as dumb as the “Chia Pet Movie”, is not one of those good use cases. Because if the Emperor has no clothes, giving him a bath won’t make him any less naked.

A shameless plug:

Wow! What a coincidence! You are not going to believe this, but if you want to find out more about STOs and DSOs and where they make sense, including what is required to run them compliantly, I have actually just released a 100% Free Security Token Crash Course on YouTube! What impeccable timing! What are you waiting for? It’s free!